In the dynamic world of financial markets, traders are constantly in search of advanced techniques that provide them with an edge over the competition. Harmonic patterns, a sophisticated form of technical analysis, have been gaining traction among traders seeking precision and accuracy in their trading strategies. In this article, we will delve into the art of mastering harmonic patterns and explore why traders are increasingly embracing these advanced techniques.

Harmonic Patterns: A Brief Overview

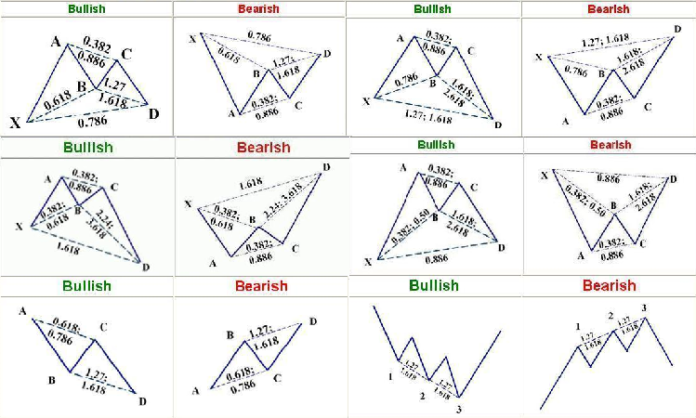

Harmonic patterns are a subset of technical analysis tools that are rooted in the principles of Fibonacci ratios and geometric shapes. These patterns are designed to identify potential reversal points in the price of an asset with an impressive degree of precision. They are named after specific geometric shapes, such as the Gartley, Butterfly, Bat, and Cypher patterns, each with its unique structure and rules.

The key idea behind harmonic patterns is that price movements in financial markets often exhibit repetitive patterns due to the collective behavior of traders. Harmonic patterns capitalize on this concept by pinpointing areas where price is likely to reverse based on Fibonacci retracement levels and confluence zones.

The Appeal of Harmonic Patterns

Precision Entry and Exit Points: One of the primary attractions of harmonic patterns is their ability to provide traders with precise entry and exit levels. Traders can identify these levels by applying Fibonacci ratios to the specific price swings within a pattern, allowing them to execute trades with a high degree of accuracy.

Visual Clarity: Harmonic patterns are easily recognizable on price charts due to their distinct geometric shapes. This visual clarity makes them an invaluable tool for traders, enabling them to spot potential trading opportunities quickly.

Risk Management: Harmonic pattern also assist traders in effective risk management. By clearly defining entry and exit points, traders can set stop-loss orders and calculate their risk-reward ratios with precision, helping to protect their capital in volatile markets.

Mastering Harmonic Patterns

To truly master the art of harmonic pattern, traders must go beyond recognizing the basic shapes. Here are key steps to take:

Pattern Recognition: Begin by mastering the identification of harmonic pattern. Each pattern has its own unique structure and Fibonacci ratios, so it’s essential to become proficient in recognizing them on price charts.

Confluence Zones: Successful harmonic pattern trading often involves looking for confluence zones where multiple technical factors align. These can include support and resistance levels, trendlines, and Fibonacci retracement levels. When harmonic patterns form within these zones, they tend to be more reliable.

Backtesting and Practice: Practice is crucial to mastering harmonic pattern. Traders should backtest their strategies using historical data to assess the effectiveness of their trading approach. Additionally, they can use demo accounts to gain practical experience without risking real capital.

Continuous Learning: Stay updated with the latest developments in harmonic pattern trading. The field of technical analysis is ever-evolving, and traders who continuously seek to expand their knowledge are more likely to excel.

Conclusion

The art of mastering harmonic patterns is an exciting journey for traders seeking advanced techniques in the financial markets. These patterns offer precision, visual clarity, and risk management capabilities that can be particularly valuable in today’s volatile trading environment. However, it’s essential to remember that, like any trading strategy, harmonic patterns are not foolproof. Success requires discipline, continuous learning, and a well-rounded understanding of market fundamentals. Traders who commit to mastering harmonic pattern can find themselves well-equipped to navigate the complexities of modern trading and achieve their financial goals.

Click to sign up with ICMarkets

Related Articles:

Forex Patterns : Mastering A Key Reversal Pattern in Trading