Profit sharing in forex trading refers to an arrangement where multiple individuals or entities pool their capital together to participate in forex trading, and the profits generated from the trading activities are distributed among the participants based on a predetermined sharing ratio.

Here’s a general overview of how profit sharing in forex trading works:

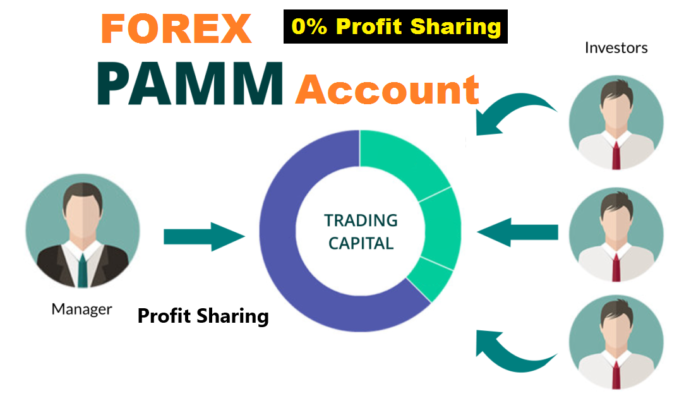

- Participants: A group of investors or traders come together to pool their funds and form a trading partnership or investment pool.

- Capital contribution: Each participant contributes a certain amount of capital to the trading pool. The proportion of the capital contributed by each participant often determines the sharing ratio for distributing profits.

- Trading strategy: The trading pool typically appoints a professional trader or a team of traders to execute forex trades on behalf of the participants. The traders implement a trading strategy aimed at generating profits.

- Trading activities: The appointed traders utilize the combined capital to conduct forex trades. They analyze market conditions, make trading decisions, and execute trades with the goal of generating profits.

- Profit calculation: At regular intervals, usually monthly or quarterly, the trading activities’ performance is assessed, and profits or losses are calculated based on the overall trading results.

- Profit distribution: The profits generated from the trading activities are distributed among the participants according to the predetermined sharing ratio. The sharing ratio can be based on the initial capital contribution or any other agreed-upon criteria.

- Fees and expenses: It’s common for profit sharing arrangements to include provisions for fees and expenses. The traders may charge a performance fee or management fee for their services. Additionally, expenses related to trading, such as transaction costs or software subscriptions, may be deducted before profit distribution.

It’s important to note that profit sharing arrangements in forex trading may involve legal and regulatory considerations, depending on the jurisdiction. It’s advisable for participants to consult with legal and financial professionals to ensure compliance with relevant laws and to draft appropriate agreements outlining the terms and conditions of the profit sharing arrangement.

Furthermore, forex trading is inherently risky, and there are no guarantees of profits. Participants should carefully evaluate the trading strategy, track record of the traders, and consider the potential risks before entering into a profit sharing arrangement in forex trading.

Read more: Forex Patterns : Mastering A Key Reversal Pattern in Trading